服务热线 :+86-02558866190 简体中文 English

服务热线 :+86-02558866190 简体中文 English

Xinzhijia - Gathering the viewpoints of industry, academia, research and enterprise experts, comprehensively analyzing the opportunities and challenges of AI chips, third-generation semiconductors, and others in the era of automotive "big transformation"!

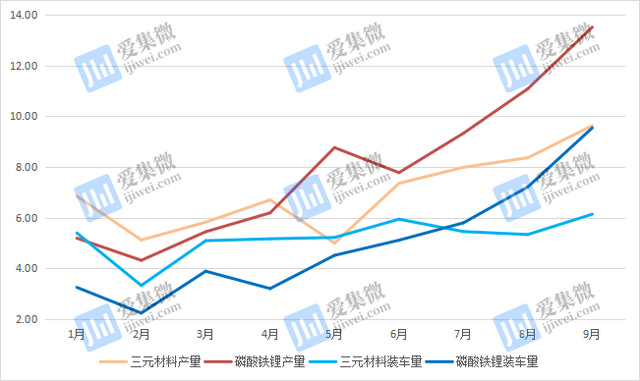

According to Jiweiwang, the competition for power battery routes has never stopped, with ternary materials, lithium iron phosphate, lithium manganese oxide, and lithium titanium oxide being the four main routes promoted by domestic enterprises. Under the promotion of policies, the use of ternary materials to compress lithium iron phosphate has gradually become the mainstream in the market. But since entering 2021, lithium iron phosphate has changed its previous decline and grown rapidly, surpassing ternary materials in production and loading in May and July respectively.

In September, the production and installation of lithium iron phosphate batteries increased significantly again. Combined with data from recent months, the increment of lithium iron phosphate is increasing, and the gap with ternary materials is also increasing. According to Chen Lei, an analyst in the lithium battery industry, after the policy downturn, lithium iron phosphate and ternary materials have returned to the same starting line. With its lower price, longer lifespan, and safer application characteristics, lithium iron phosphate has gained more favor from car companies.

Subsidies fade, and lithium iron phosphate reverses with three major advantages

The domestic new energy vehicle power battery technology routes mainly include four routes: ternary materials, lithium iron phosphate, lithium manganese oxide, and lithium titanium oxide. Currently, the production and sales of lithium manganese oxide and lithium titanium oxide are very small; And ternary materials and lithium iron phosphate not only occupy the main market share, but their market competition has never stopped. Previously, ternary materials dominated lithium iron phosphate and became the mainstream of the market. However, starting from May this year, lithium iron phosphate batteries first surpassed ternary materials in production, and then surpassed ternary materials in vehicle installation in July.

According to the latest statistics from the China Automotive Power Battery Industry Innovation Alliance, lithium iron phosphate batteries once again surpassed the production and installation of ternary lithium batteries in September, and this gap is still widening. Among them, the installation of lithium iron phosphate batteries is already very close to the production of ternary materials.

Trends in production and loading of lithium iron phosphate and ternary materials from January to September this year(Unit: GWh, Source: China Automotive Power Battery Industry Innovation Alliance)

Lithium battery industry analyst Chen Lei (pseudonym) said, "In fact, as early as 2020, lithium iron phosphate batteries showed a momentum to surpass ternary lithium batteries." Chen Lei's analysis believes that compared to ternary materials, the three advantages of lithium iron phosphate are important reasons for its return to the top of the new energy vehicle power battery rankings.

Firstly, it is safety. Lithium iron phosphate batteries have higher high-temperature adaptability. During discharge, the internal stability is 30 ℃ higher than the external temperature, and the battery will not be damaged; When encountering structural damage, lithium iron phosphate batteries are also less prone to spontaneous combustion, explosion, and other phenomena. In a puncture experiment conducted by BYD, it only took 1.5 seconds for the ternary lithium battery to explode from being penetrated by a steel needle; When conducting the same experiment on blade batteries, there was no open flame, no smoke, and the surface temperature of the battery was only 30 ℃ -60 ℃, far lower than the surface temperature of 500 ℃ for ternary lithium batteries, indicating obvious safety.

Secondly, it has a longer service life. Thanks to its ultra long cycle life advantage, lithium iron phosphate can still maintain a battery capacity of 93% after undergoing 2000 0.5C rate charges and 1C rate discharges. BYD stated that its new generation of lithium iron phosphate batteries can provide a lifespan guarantee of 8 years and 1.2 million kilometers.

The third is cost advantage. Lithium iron phosphate raw materials are easier to obtain and have a lower cost than ternary lithium batteries. As the production and sales of new energy vehicles continue to increase, the supply of cobalt and nickel, the two scarce raw materials required for ternary lithium batteries, continues to be tight. Especially this year, the price of lithium battery raw materials continues to rise, causing ternary lithium battery manufacturers to bear greater cost pressure. As of October 15th, the price of electrolytic cobalt has skyrocketed from 270000 yuan/ton at the beginning of the year to 380000 yuan/ton; The price of electrolytic nickel has been adjusted again by 1500 yuan/ton to 140000 yuan/ton; Although the price of lithium iron phosphate is also rising, the current price of 74000 yuan/ton still appears more affordable.

The regaining of market recognition for lithium iron phosphate batteries is subject to market testing, such as Tesla's domestically produced Model Y standard range version. After using lithium iron phosphate batteries, the range is only shortened by 60 kilometers for the longer and high-performance versions, but the price has decreased by 70000 to 100000 yuan. BYD's car sales, which use lithium iron phosphate batteries throughout the entire series, are also very good, driving other car companies to follow up and adopt the lithium iron phosphate solution. We believe that lithium iron phosphate has already It has been favored by various host manufacturers Chen Lei said.

The real reason for bringing lithium iron phosphate and ternary lithium back to the same starting line is the significant reduction in subsidies for new energy vehicles. It is understood that the "Energy Conservation and New Energy Vehicle Industry Development Plan (2012-2020)" released in 2012 proposed that by 2020, the specific energy density of power battery modules should reach 300Wh/kg or above. "This means that the higher the energy density, the greater the subsidy received, and this indicator requirement can only be achieved by ternary lithium batteries. This is also an important reason why ternary lithium batteries have achieved rapid development before."

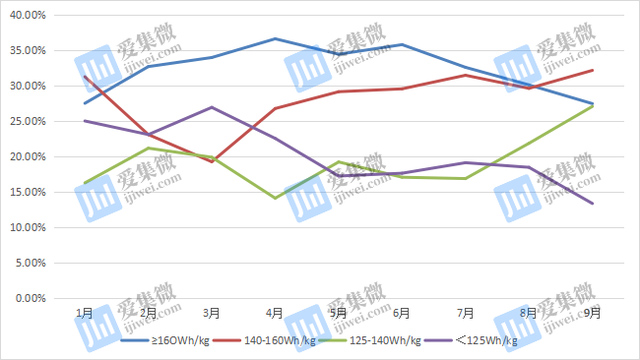

But after 2020, the subsidy decline gradually returned to zero, and the main factors driving the development of ternary lithium batteries disappeared, replaced by market mechanisms. The fact shows that the market chose lithium iron phosphate. Chen Lei stated that the industry's attention to energy density has significantly decreased, and whether it is lithium iron phosphate or ternary materials, the energy density ceiling is difficult to break through. Currently, in these two technical solutions, the energy density of lithium iron phosphate loaded on vehicles is mainly 150Wh/kg, while that of ternary lithium batteries loaded on vehicles is 160Wh/kg. The difference between the two is not significant. Under the demand for lower cost, safer, and longer lifespan, lithium iron phosphate is returning, It is the choice of the market.

Trends in the installed volume of batteries with different energy densities from January to September (source: China Automotive Power Battery Industry Innovation Alliance)

According to the statistics of the China Automotive Power Battery Industry Innovation Alliance, from January to September this year, the proportion of batteries with energy densities of<125Wh/kg and ≥ 16OWh/kg in the vehicle load showed an overall downward trend, especially in the second half of the year, the downward trend accelerated; The proportion of battery loading in the energy density ranges of 125-140Wh/kg and 140-160Wh/kg is increasing. Among them, by September, the proportion of battery loading in the energy density range of 140-160Wh/kg has risen to the first place in the market.

International giants have entered the market, and the domestic market share of lithium iron phosphate has exceeded 60%

As the lithium iron phosphate technology solution returns to the forefront in China, international power battery manufacturers have also announced the layout of the lithium iron phosphate technology route.

In fact, the characteristics of lithium iron phosphate electrode materials were first discovered and studied by Japanese and American scientists in the 1990s. Due to their wider raw material sources, lower prices, and no environmental pollution, they have been widely promoted and used in developed countries such as the United States and Japan.

However, due to its low energy density, foreign new energy vehicle manufacturers are more inclined to use ternary materials, especially Tesla's early cooperation with Panasonic, which further elevated the position of ternary materials in the field of electric vehicles.

In July 2012, the American A123 Systems company, a lithium iron phosphate giant with a cumulative loss of about $700 million, filed for bankruptcy, marking the decline of the international lithium iron phosphate technology route. Chen Lei said that except for Chinese Mainland, power batteries in overseas markets are basically ternary materials, and lithium iron phosphate has not been industrialized.

As upstream materials continue to be scarce, the manufacturing and usage costs of ternary materials continue to rise. In order to meet the constantly rising electric vehicle market, overseas power battery giants have also begun to layout lithium iron phosphate solutions.

Especially after globally renowned brands such as Hyundai, Volkswagen, Porsche, and General Motors experienced car spontaneous combustion incidents, power battery supplier LG Chem was pushed to the forefront of the trend, accelerating the process of returning to lithium iron phosphate solutions in overseas markets. Among them, in the recall of Hyundai due to spontaneous combustion, LG Chem had to bear 70% of the loss of 1.4 trillion Korean won (approximately 5.6 billion RMB); In the General Motors recall, LG Chem lost another $1.9 billion (approximately RMB 12.25 billion).

It is understood that LG Chemical has spun off and established LG Energy Solutions Company at the end of 2020, focusing on the research and development of lithium iron phosphate battery technology. According to the latest reports from overseas media, LG New Energy Solutions Company is expected to build a trial production line for lithium iron phosphate batteries in 2022, after consecutive incidents of spontaneous combustion of ternary lithium batteries.

Recently, another power battery giant in South Korea also announced its entry into the field of lithium iron phosphate. The CEO of SKI stated on October 5th, "We are considering developing LFP (lithium iron phosphate) batteries. Despite their low capacity density, they have advantages in cost and thermal stability."

Chen Lei stated: "The risk of flammability in ternary lithium batteries is accelerating the global power battery market's entry into the lithium iron phosphate market. As of now, among the top five power battery companies in the world, CATL, LG New Energy, BYD, and SKI have all entered this field, leaving only Panasonic to not yet develop a lithium iron phosphate technology route. However, the process from layout to mass production of lithium iron phosphate still requires a long time, at least a year of preparation."

On the other hand, the host factory has also started importing lithium iron phosphate batteries in advance. Hyundai Motor announced on October 8th that it has started developing electric vehicles equipped with lithium iron phosphate batteries in the first half of this year, which will be launched outside of China. On October 14th, electric vehicle company Electric Last Mile Solutions, Inc. also announced that it had reached an agreement with CATL to supply it with lithium iron phosphate batteries.

NIO Automobile, one of the leading domestic new forces in car manufacturing, was not optimistic about lithium iron phosphate by its founder Li Bin. However, in its recently released new generation battery patent, it mixed and matched lithium iron phosphate batteries with ternary lithium-ion batteries, and named it the "ternary lithium iron battery pack".

It should be noted that among the top 10 best-selling BEV models in the domestic market from January to August, the Wuling Hongguang Mini, Tesla Model 3, Tesla Model Y, BYD Han, Euler R1, Aion S, Mercedes Benz, Chery eQ1, Xiaopeng P7, Roewe Clever, and other 7 models have all been equipped with lithium iron phosphate batteries.

It is obvious that lithium iron phosphate batteries are rapidly returning to the market and are gaining momentum. Some people are starting to worry about the future prospects of ternary materials; However, in Chen Lei's view, lithium iron phosphate will not replace ternary materials, but rather coexist with the two.

At present, most domestic power battery companies have a balanced layout of lithium iron phosphate and ternary lithium. Even BYD, which has all models equipped with lithium iron phosphate batteries, has developed ternary lithium batteries and supplied them to Ford. Balancing two technological routes is also considered as one of the measures for enterprises to cope with future changes in the power battery market.

In terms of lithium iron phosphate, BYD has the greatest influence, but its production is the highest in CATL, and Guoxuan High tech is also one of the top three players. According to the prospectus of Hunan Yuneng, the largest domestic exporter of lithium iron phosphate battery cathode materials, the revenue from Ningde Times accounted for 58.07% of its total revenue in the first quarter of this year, followed by BYD at 38.92%.

It should be pointed out that although lithium iron phosphate returns rapidly, the inherent bottleneck of this solution still exists. In terms of energy density, although enterprises represented by Guoxuan High tech have broken through the 210Wh/kg bottleneck, there is still a significant gap compared to the peak energy density of 350Wh/kg ternary lithium batteries. Even though BYD's blade batteries can indeed increase energy density and reduce costs through structural changes, they have not fundamentally changed the energy density and other shortcomings of lithium iron phosphate.

Lithium iron phosphate batteries also experience power failure in low-temperature environments, which is an unavoidable issue for electric vehicles that require stable range. Chen Lei said, "Both technological routes have their own advantages and disadvantages, and the shortcomings of the lithium iron phosphate solution also leave enough room for the development of ternary materials."

Chen Lei further analyzed that in the field of ternary materials, the domestic advantage is the huge production capacity, but international enterprises have a slight advantage in progressiveness technology, which is also the reason why international enterprises have always focused on high-end power batteries. Vehicles loaded with such batteries can obtain a more stable driving experience, which has little impact on the high-end car market, which is relatively insensitive to price, "We predict that the market share of two types of power batteries, lithium iron phosphate and ternary materials, will maintain a trend of four to six openings in the future," said Chen Lei. According to the latest statistics from the China Automotive Power Battery Industry Innovation Alliance, the market share of domestic lithium iron phosphate reached 60.8% in September, while the market share of ternary materials decreased to 39.11%.